Insurance Policies Explained: Your Complete Guide to Financial Safety

In today’s fast-paced world, uncertainties are everywhere — from medical emergencies and car accidents to natural disasters and unexpected life events. One smart way to shield yourself from the financial consequences of these events is through insurance. Whether you’re a first-time buyer or just looking to understand policies better, this guide will walk you through the essentials of insurance, how it works, the different types available, and how to choose the right one.

✅ What Is an Insurance Policy?

An insurance policy is a formal contract between an individual (or entity) and an insurance provider. Under this agreement, the insurer commits to offering financial protection or reimbursement in case of losses covered under the policy. In return, the policyholder agrees to pay a premium—a specific amount either monthly, quarterly, or annually.

An insurance policy is a formal contract between an individual (or entity) and an insurance provider. Under this agreement, the insurer commits to offering financial protection or reimbursement in case of losses covered under the policy. In return, the policyholder agrees to pay a premium—a specific amount either monthly, quarterly, or annually.

Insurance works on the principle of risk pooling: many people pay small amounts (premiums) into a common fund, and those who face genuine losses are compensated from that pool.

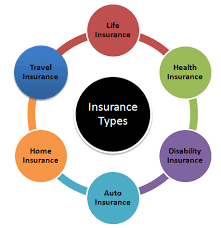

# Common Types of Insurance Policies

Understanding the different types of insurance can help you choose the ones that best meet your needs:

1. Health Insurance

Health insurance helps cover the costs of medical care, including doctor visits, hospitalization, surgeries, medicines, and even preventive services. With rising healthcare costs, health insurance is no longer a luxury—it’s a necessity.

Popular features include:

-

Cashless treatment in network hospitals

-

Daycare procedure coverage

-

Maternity benefits

-

Pre- and post-hospitalization expenses

2. Life Insurance

Life insurance provides financial security to your dependents in case of your untimely death. It ensures your family can continue to meet their expenses, pay off debts, or fund long-term goals like education.

Types include:

-

Term Insurance: Affordable, provides high coverage for a fixed term.

-

Whole Life Insurance: Covers you for your entire life.

-

Endowment Plans & ULIPs: Combine insurance with savings/investments.

3. Motor Insurance

Required by law in most countries, motor insurance protects you against losses from accidents, theft, or third-party damages involving your vehicle.

Coverage types:

-

Third-party insurance (mandatory)

-

Comprehensive insurance (own damage + third-party)

-

Add-ons: Zero depreciation, engine protection, roadside assistance

4. Home Insurance

This policy protects your home and its contents from risks like fire, theft, natural disasters (floods, earthquakes), or vandalism. You can also insure valuable items like electronics or jewelry.

5. Travel Insurance

When traveling domestically or internationally, travel insurance covers issues such as trip cancellations, lost baggage, flight delays, and medical emergencies abroad.

# Key Elements of an Insurance Policy

To understand your policy fully, it’s important to know these terms:

-

Premium: The price you pay regularly to keep the policy active.

-

Coverage/Sum Assured: The amount the insurer agrees to pay in case of a covered event.

-

Deductible: The initial portion of expenses that the policyholder must pay before the insurance coverage kicks in.

-

Exclusions: Situations or conditions not covered by the policy.

-

Riders/Add-ons: Optional benefits you can buy to enhance your coverage.

-

Claim: A formal request made to the insurer to get compensation under the policy terms.

# Why Do You Need Insurance?

1. Financial Protection

Insurance cushions the financial blow caused by unexpected events. For example, a serious illness can wipe out your savings without a health insurance policy.

2. Peace of Mind

Knowing you’re protected allows you to focus on recovery or solutions instead of worrying about money during a crisis.

3. Wealth Preservation

Without insurance, you might be forced to sell assets or take on debt to handle emergencies. Insurance helps avoid this.

4. Legal Requirements

Certain types of insurance (e.g., motor insurance) are legally mandated in many countries.

# How to Choose the Right Insurance Policy

Selecting the right insurance policy requires careful thought. Here are some practical tips:

✔️ Assess Your Needs

Start by evaluating your financial situation, dependents, health conditions, assets, and liabilities. This will help determine the kind and level of coverage you need.

✔️ Compare Plans

Don’t settle for the first policy you find. Use comparison websites or speak to multiple agents to understand the best offerings in terms of premiums, benefits, and features.

✔️ Understand the Fine Print

Always read the policy documents carefully. Pay attention to waiting periods, claim processes, coverage limits, and exclusions.

✔️ Check the Insurer’s Reputation

Look for companies with a high Claim Settlement Ratio (CSR), strong customer service, and transparent practices.

✔️ Opt for Riders If Needed

Add-ons can provide customized protection (e.g., critical illness rider with life insurance).

# What to Keep in Mind During Claims

Filing an insurance claim can be smooth if you follow the correct steps:

-

Notify the insurer immediately after the incident.

-

Submit all necessary documents (such as FIRs, medical bills, ID proof).

-

Cooperate during inspections or evaluations.

-

Track the claim status regularly.

Timely communication and complete documentation are essential for hassle-free claim approval.

🔚 Conclusion

Insurance is more than just a policy; it’s a safeguard against life’s uncertainties. While it cannot prevent unfortunate events, it can help ease their financial burden. The key lies in understanding what you’re buying, choosing plans suited to your lifestyle, and keeping policies up to date.

Whether you’re securing your health, life, property, or travels — the right insurance policy can bring security, stability, and peace of mind when you need it the most.